Property Taxes: The Silent Killer

[6 min] Why & how to contest your property taxes

Property taxes, especially in San Francisco, are sneaky. They’re paid in two installments per year. It’s the perfect frequency to fly just under your radar: not quite monthly, which would pile onto your subscription fatigue, but also not annually where you verbally gripe about it to a friend, like income taxes. However, if you take the average SF home ($1.3M), multiply that by the tax rate of 1.17%, and turn it into a monthly figure, you’re looking at a $1,300/mo subscription. Yikes!

I went down the rabbit hole, appealed mine, and attended multiple hearings to learn about this fascinating process. Here’s my experience, what I learned, and what you can do to save.

Step 1: Find your home details

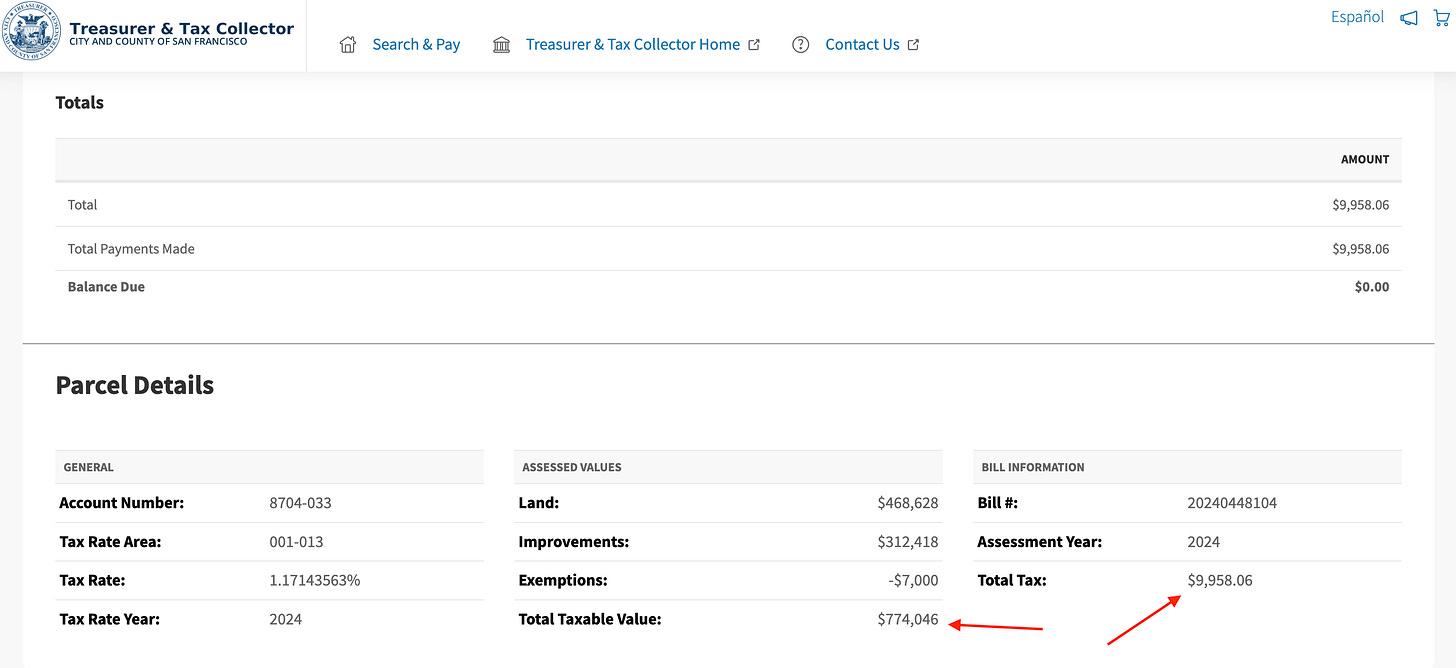

Go to the SF Treasurer’s Office website and type in your address. Look up your tax bill and make a note of your Total Taxable Value, Total Tax, and the two installment due dates at the top (usually mid-April and mid-December):

Note: do not miss these payments! If you do, you cannot appeal. Even if you’re reading this late, just pay before the deadline. You can still appeal and will receive a refund check, if successful.

Step 1b: Did you catch that $7K Exemption?

Quick detour: did you notice the $7,000 exemption right above the Total Taxable Value on my tax bill above? Every homeowner living in their home in SF should have this. If not, do it. Stop reading. Do it now. It can even be emailed. Here’s the form and the website to file it. Even if you miss the Feb 15 “deadline,” you can still receive 80% of this value.

This process is free, easy to do, and only needs to be done once. That’s $83 of savings per year in perpetuity. Now your Costco membership is free. You’re welcome.

Step 2: Choose the right process

Back to the meat of it. There are 2 options for lowering your property taxes and which option you choose (you can choose both) depends on when you’re reading this article:

Informal Review (Jan 2 - Mar 31)

Formal Review aka “Appeal” (Jul 2 - Sep 15)

Option 1: Informal Review (Jan 2 - Mar 31)

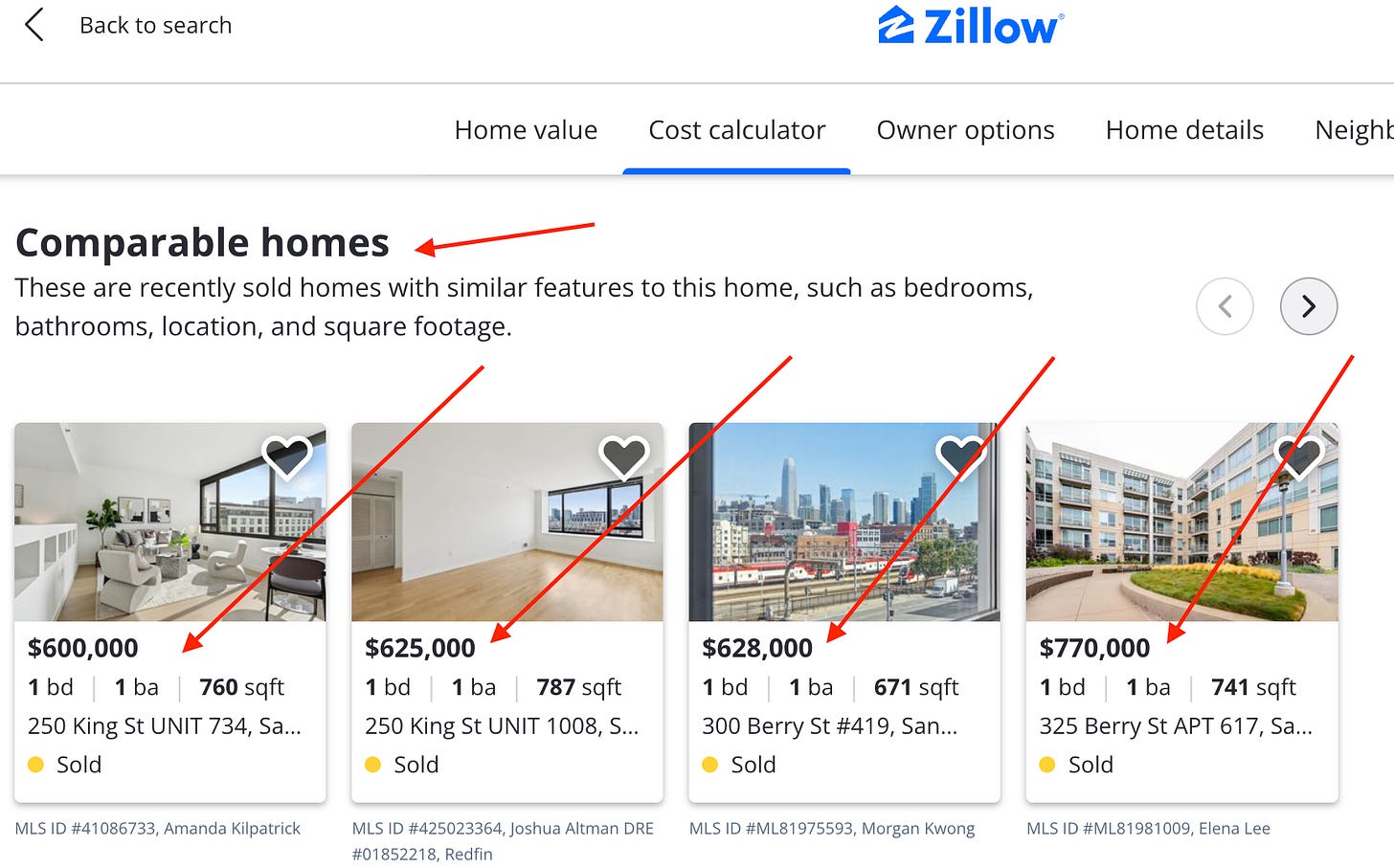

This process is fairly quiet: it’s handled by the staff and there is no hearing: an introvert’s dream. You fill out an online form and randomly get an answer via snail-mail in July. Want to know if this is right for you? Go to Zillow, type in your address, and scroll down to the Comparable Homes section:

If you see some comparable sales that are lower than your Total Taxable Value, this may be a smart route to pursue. Find at least two comparables that you like and submit them here by March 31st. Pro tip: filter “sold dates” to as close to Jan 1 as possible, but no later than Mar 31.

Option 2: Formal Review / Appeal (July 2 - Sep 15)

This process is a little more involved, but I still encourage it. You submit the appeal form using comparables (same as Option 1). However, this time, you follow the decline-in-value section on the same website, pay a $120 fee (previously, $60), and might have someone from Assessor’s office contact you.

First, submit this form either online or via snail-mail along with your comparables. Then, if they contact you, they will ask: “How did you come up with your number?” Be prepared for this. I was able to use my RE background to handle this on the spot. But I recommend having your comparables home sales ready to explain your methodology.

Then, they will either agree, disagree, or say they need more time. In any case, the next step is to attend a virtual meeting. This scheduling may take up to 1-2 years - yes, you read that correctly. But do not miss this meeting; even if they agreed with your valuation, missing is automatic grounds for denial.

In the last meeting I attended, an owner of a gorgeous 2bd Marina condo (that I may or may not have Zillow-stalked) didn’t show up. Like all no-shows, their appeal was auto-denied. Based on what I dug up on public records, this missed meeting decision cost them $3,371/year — or $281/month in lost cashflow. Do not miss your meeting!

Step 3: Attend the Meeting

Also, the meetings are really intriguing! If they agreed with your valuation, you’re in the first part of the agenda and it’s a quick and easy process:

Raise right hand, swear under oath you’re not lying

Confirm you’ve agreed and that you’ll pay the fee

Done, you can leave the meeting

This is what happened to me. But obviously, I didn’t leave. I wanted to hear the next part of the meeting: those that disagreed. The rebels. The misfits. The vigilantes. The ones ready for the heated debate.

Turns out, it was much more civil and less dramatic than I expected/hoped. If they disagree with your valuation, you debate it out in a very calm and structured process, each sharing your POV for 2 mins, followed by a 1 min rebuttal.

There were various methodologies used in the debates. The most prominent valuation basis was to use sales comparisons, and it’s the one most well-received by the committee making the decision. Therefore, I’m also recommending it to my readers and providing a template to make it easy for you:

The second most used method was lease-based: value based on a multiple of rental income. The third was the most intriguing: socioeconomic-based. It was also the least well-received, likely because it’s the most subjective. Essentially, owners sharing the changes in the neighborhood that have occurred, such as higher crime, change in school zones, infrastructure divestments, etc. They’re valid points - they’re just harder to quantify.

Sometimes, you hear the triggering, yet famous line of your coworker that got caught off guard in a meeting… “Let’s take this offline.” Yep - the city has that power. They can hear arguments, but they are not required to render a verdict in the moment. This happened once when there was a mildly-heated argument over the difference in value for a tandem vs. deeded parking space. The committee takes away the notes and deliberates in closed session. The public doesn’t hear the final discussion, but it gets mailed to the owner.

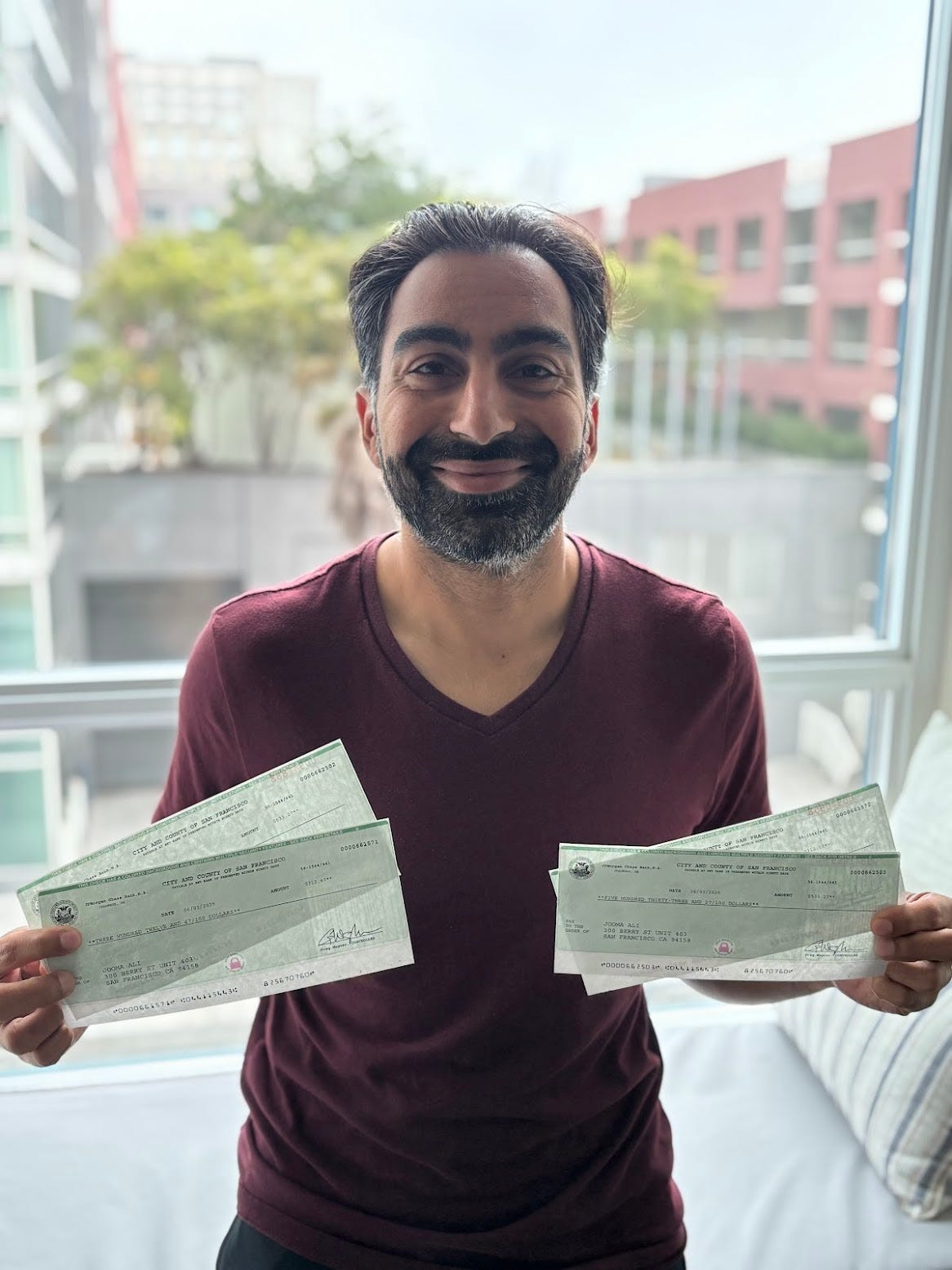

That’s it. After a few weeks, you will receive your new notice in the mail. You will pay that amount, or get a refund check if you’ve already paid. The unfortunate part: this is only a one-year reduction and the city will re-evaluate the following year, usually based on their original assessed value.

My results

I did both options listed in Step 2 above (one for 2023 and one for 2024) using the sales-comparables based method. This successfully resulted in a $43,000 reduction for each year, which netted me a refund check of $845 per year:

Some cool math

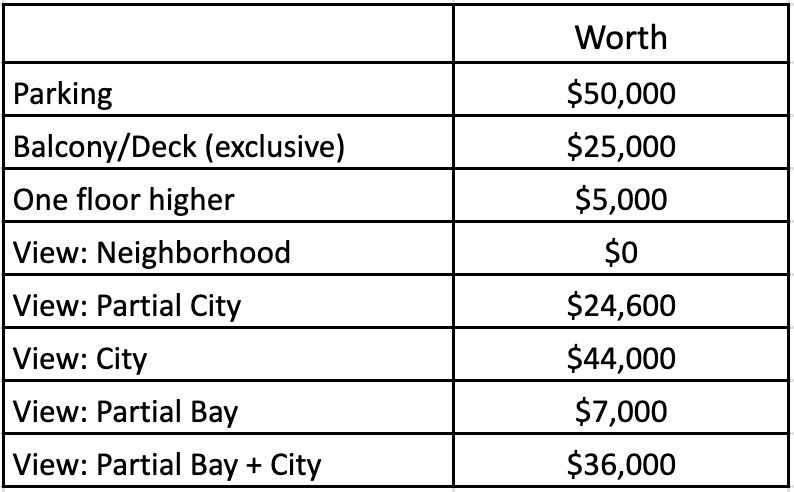

I got curious and dug deeper after the hearing. I also took some data from friends and computed how the city values certain aspects of living and it’s fascinating and relatively precise. Here are some examples, limited to my part of SF:

I find this riveting. Would you pay $25K for a private balcony? Or, pay $44K to have a city skyline view? I know, it’s the ideal dinner conversation. Next time you see me, let’s nerd out about it!